How to Save Money on Commercial Auto Insurance in Jacksonville, FL (2025 Guide)

If you own a business in Jacksonville, you already know commercial auto insurance in Florida isn’t cheap. The question is: how do you protect your business vehicles without draining your budget? We help contractors, delivery fleets, landscapers, construction, and service trades across Jacksonville stay insured and on budget.

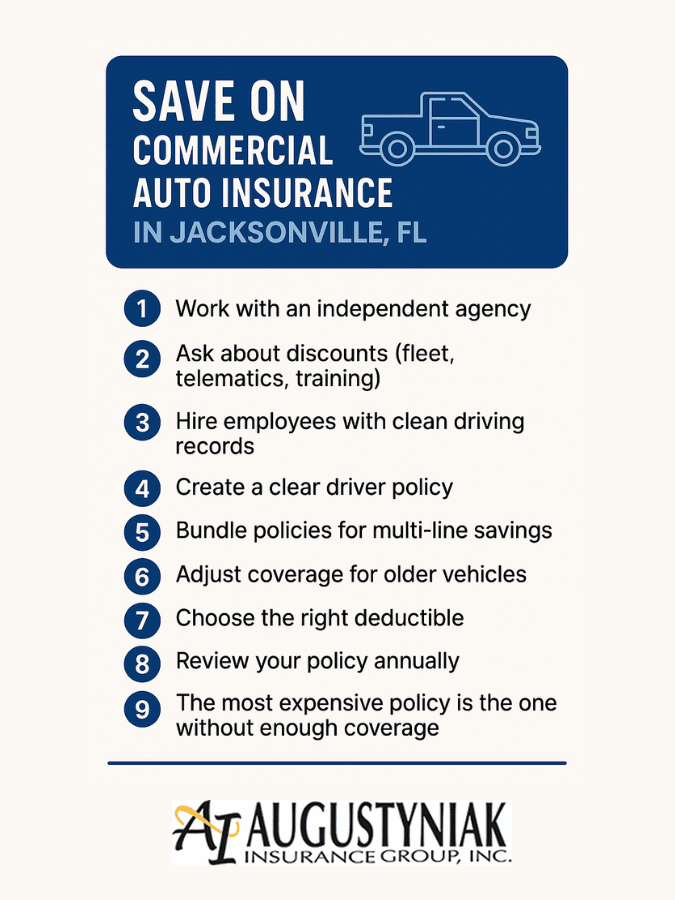

In this article, we are breaking down nine proven ways to control costs on commercial auto insurance policies in 2025. The answer isn’t chasing the cheapest quote—it’s knowing where real savings hide..And that’s exactly what we’ll show you.

9 Proven Ways to Save on Commercial Auto Insurance in Jacksonville

Quick Savings Checklist for Commercial Auto Insurance

Short on time? Here are proven ways Florida businesses can cut costs without cutting coverage:

- 1- Work with an independent insurance agency to compare top carriers.

- 2- Ask about discounts like fleet pricing, telematics, and driver training.

- 3- Hire employees with a clean driving record and conduct a background check before making a job offer.

- 4- Create a clear driver policy (eligibility standards, violations).

- 5- Bundle with general liability or workers’ comp for a multi-policy discount.

- 6- Review coverage on older vehicles to avoid overpaying.

- 7- Choose a deductible that matches your cash flow and risk tolerance.

- 8- Review your policy annually to uncover new savings opportunities.

- 9- The most expensive policy is the one without enough coverage

- 👉 Ready to put these savings to work? Get a Commercial Auto Insurance Quote in minutes.

1. Work With an Independent Agency

Don’t waste time chasing quotes. An independent insurance agency can compare rates from multiple carriers at once—so you see the best options side by side. We recommend choosing one trusted broker and asking them to shop the market for you. That way, you’ll get a clear picture of rates from the major companies without the hassle.

At Augustyniak Insurance Group, we regularly shop top-rated companies to help Jacksonville businesses find affordable commercial auto insurance that balances cost and protection. This saves you money while making sure your business vehicles are properly covered.

⭐ Looking for a commercial auto insurance agent?

Augustyniak Insurance is trusted by 2,000+ Florida families & businesses — 4.9★ on Google.

Serving Florida for over 20 years

2. Ask About Discounts (Fleet, Telematics, Training)

Many Florida insurance companies offer valuable ways to reduce your premiums if you know what to ask for.

Common discounts include:

- Multi-vehicle fleet pricing – when you insure several vehicles under one policy.

- Telematics and GPS monitoring – carriers may reward businesses that track their vehicles and drivers to improve safe driving behavior. Businesses like SambaSafety, Verizon Connect can help you with fleet monitoring

- Defensive driver training – lower risk and fewer claims often translate into lower rates.

These savings aren’t always advertised. Working with an experienced independent agent makes it easier to identify which carriers in Jacksonville and across Florida offer the most competitive discounts for your type of business.

3. Hire Employees With Clean Driving Records

Your insurance premium is directly tied to the driving history of the people behind the wheel. Hiring employees with clean driving records helps keep your commercial auto insurance rates lower, since carriers see your fleet as less risky.

Even one driver with multiple violations or accidents can raise your overall premium. By making safe driving a hiring priority—and reinforcing it with ongoing training—you can protect your business on the road and your bottom line.

When hiring, go a step further by checking each candidate’s Motor Vehicle Record (MVR):

- Get Employee Consent: Always obtain signed authorization separate from the job application.

- Use a Qualified Consumer Reporting Agency (CRA): Partner with a reputable background check provider such as GoodHire or Checkr to ensure accuracy and compliance.

4. Create a Clear Driver Policy

Insurance companies care just as much about your drivers as they do about your vehicles. A written driver policy sets the standard for who can—and cannot—operate company vehicles, helping you reduce risk and keep premiums lower.

For example, your policy might state that employees with a DUI, more than two tickets, or a recent at-fault accident are not eligible to drive. Setting these expectations upfront shows insurers you take safety seriously and helps prevent surprises that could raise your rates.

5. Bundle Policies for Multi-Line Savings

One of the easiest ways to lower your commercial auto insurance costs is by bundling policies. When you combine your commercial auto policy with other coverages—such as general liability, workers’ compensation, or a commercial umbrella—most Florida carriers offer a multi-policy discount.

Bundling not only saves money but also simplifies your billing and policy management. Fewer bills, fewer logins, and coordinated coverage—one streamlined package protecting your business from multiple risks.

👉 Ready to see how much you could save with a bundle? Request a custom quote.

6. Adjust Coverage for Older Vehicles

Not every vehicle in your fleet needs the same level of insurance. For older or lower-value units, it may make sense to reduce or even remove physical damage coverage (collision and comprehensive). This part of your policy protects the vehicle itself in the event of damage or destruction. It does not affect the liability coverage that protects your business from lawsuits or claims against you.

If the annual premium for collision or comprehensive is close to the actual market value of the vehicle, you could be paying more than it’s worth to insure. In those cases, scaling back coverage can free up valuable budget while keeping your newer or higher-value vehicles fully protected where it matters most.

When to Consider Dropping Comprehensive or Collision Coverage

- Vehicle’s actual cash value (ACV) is low (e.g., under $5,000).

- The premium for comprehensive/collision coverage equals 10–20% of the vehicle’s value per year.

- Vehicle is fully paid off and no longer leased/financed.

- Your business has strong reserves to cover repairs or replacement.

7. Choose the Right Deductible

Raising your deductible is one of the quickest ways to lower your commercial auto insurance premium. A higher deductible shifts more of the risk to your business, which means the insurer charges less each month.

However, the savings only make sense if your business can comfortably handle the out-of-pocket cost after a claim. The best deductible is one that balances premium savings with your company’s cash flow and risk tolerance.

8. Review Your Policy Annually

Your business isn’t static—neither should your insurance be. Fleets grow, routes expand, and drivers gain experience. A quick annual review of your commercial auto insurance policy helps uncover new discounts and ensures you’re not paying for coverage you no longer need.

Regular check-ins also give your agent a chance to compare rates with other carriers in Florida, so you stay protected at the most competitive price year after year.

9. The Most Expensive Policy Is the One Without Enough Coverage

It’s tempting to focus only on cutting costs, but the biggest financial risk comes from being underinsured when something goes wrong. One major accident or lawsuit can cost far more than you ever saved on lower premiums.

True savings means balancing affordability with protection. By making sure your commercial auto policy carries the right limits and coverage types for your business, you protect your bottom line from catastrophic losses. In other words, the cheapest policy isn’t always the best deal—the right coverage is what really saves money in the long run.

Jacksonville-Specific Savings Tips

Commercial auto insurance costs in Florida vary by location, and businesses in Jacksonville face unique challenges. Traffic congestion on I-95 and I-295, storm risks during hurricane season, and even where your vehicles are garaged can all impact premiums. That’s why it pays to work with a local agency that understands the area.

At Augustyniak Insurance Group, we help companies in Jacksonville, Orange Park, Ponte Vedra, and St. Augustine compare rates and find the right coverage. By tailoring policies to your routes, drivers, and garaging locations, you can uncover additional savings that statewide carriers might overlook.

👉 Get a Jacksonville commercial auto insurance quote today

FAQs: How to Save Money on Commercial Auto Insurance in Jacksonville, FL

What’s the best way to lower my commercial auto insurance premiums in Jacksonville?

The fastest way is working with an independent agency that can shop multiple carriers. Bundling with other policies, choosing higher deductibles, and maintaining drivers with clean records also create meaningful savings.

Can my small business still get fleet discounts in Florida?

Yes. Many insurers offer fleet pricing even for smaller businesses if you insure two or more vehicles together. Bundling your vehicles under one policy can help you qualify for these discounts.

Should I drop comprehensive or collision on older business vehicles to save money?

It depends on the vehicle’s value. If the premium for physical damage coverage is close to the vehicle’s market value, you may be paying more than it’s worth. Dropping comp or collision on older units can free up budget while keeping liability intact.

Do Jacksonville businesses get telematics or GPS monitoring discounts?

Absolutely. Many Florida carriers offer lower premiums if you use telematics or GPS fleet monitoring to encourage safer driving. Discounts vary by insurer, but they can be substantial for businesses that adopt this technology.

How often should I review my commercial auto insurance policy for savings?

At least once a year. Annual reviews uncover new discounts, updated fleet information, and carrier changes that can save money. Checking more often—after adding vehicles, drivers, or new routes—can also reveal opportunities.

What’s the risk of choosing the cheapest commercial auto insurance policy?

The lowest-priced policy often lacks the coverage limits or endorsements you’ll need when something goes wrong. One major accident could cost more than all the premiums you’ve saved. True savings mean balancing affordability with proper protection.

Next Steps: How to Lock in the Best Rates

Saving on commercial auto isn’t about the cheapest quote—it’s about smart choices that protect your business and your budget. We’ll shop top carriers, check discounts, and recommend the right bundle for you.

Other Articles about Commercial Auto Insurance

- How to Choose the Right Commercial Auto Insurance in Jacksonville Without Losing Your Mind (June 2025)

A clear, beginner-friendly guide on what commercial auto insurance covers, key types of vehicles, Florida-specific requirements, and must-have policy features. A great companion if you're just getting started. - Food Truck Insurance in Florida

Essential reading for mobile food business owners—this article covers both commercial auto insurance requirements and specialized add-on coverages like food spoilage, business property, and liability protections. - What Is Commercial Auto Insurance in Florida?

A helpful breakdown of how commercial auto insurance works in Florida, who needs it, and the types of vehicles and businesses it protects. Perfect if you want a foundational overview before diving into specialized guides.