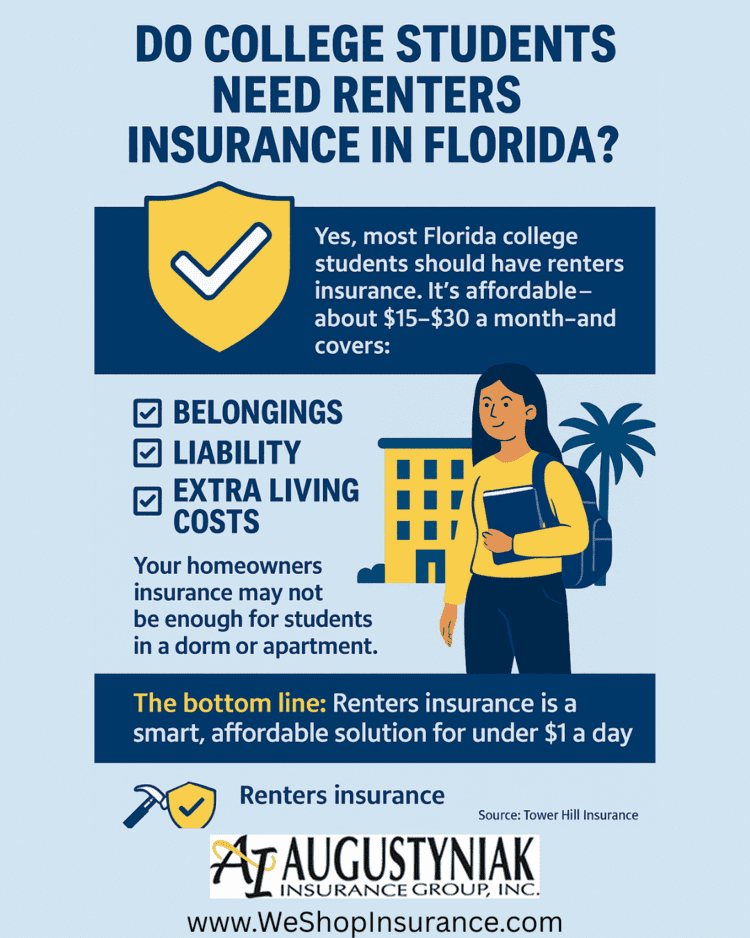

Do College Students Need Renters Insurance in Florida?

👉 Yes, most Florida college students should have renters insurance. It’s affordable—about $15–$30 a month—and covers belongings, liability, and extra living costs when homeowners insurance falls short.

Here’s what you need to know, especially if your student is living in a dorm or renting an apartment in Florida. (Source: Tower Hill Insurance)

Your Homeowners Insurance May Not Be Enough for College Students

Some parents assume their homeowners' insurance will cover a child away at school. While that can be true in certain cases, the coverage is often limited:

- Personal Property Coverage: Most homeowners policies cover a student’s belongings away from home, but usually only up to 10% of your personal property limit. Example: if you have $100,000 in coverage, only $10,000 may apply to your child’s dorm or apartment.

- Theft Limitations: Some policies only cover theft if the student has been at their college residence within the last 45 days. If your student spends a semester abroad or is away for the summer, items left behind may not be covered. Be sure to discuss with your agent if your student is moving away from the United States -- They need an international policy.

- Liability Gaps: Your policy may extend liability coverage, but usually it won’t cover damage to the rented property itself (like an apartment or dorm room).

- Loss of Use: If the dorm or apartment becomes unlivable due to fire or storm damage, homeowners insurance might help with extra living expenses — but again, only within the limited coverage amount.

Why Renters Insurance is a Smart Move for Florida Students

Florida college students face unique risks — from hurricanes and tropical storms to high theft rates in some areas. Renters insurance can provide peace of mind by offering:

- Broader coverage for personal belongings (laptops, clothing, furniture, electronics).

- Liability protection if your student accidentally causes damage or someone gets hurt in their rental space.

- Loss of use coverage to pay for hotels, food, and transportation if their rental is uninhabitable.

- Affordable premiums — renters insurance in Florida typically costs about $15–$30 per month, or less than a dollar a day.

Be sure to ask your agent about high-value items like jewelry, computers, laptops, or musical instruments. These items may need special coverage or higher limits to be fully protected.

Get a Renters Quote Now

Protect your college student’s belongings and liability today. Renters insurance is quick, easy, and affordable.

Get a Renters QuoteWhen Renters Insurance Is Especially Important for College Students

- They live off-campus in an apartment or house.

- Their college or landlord requires proof of renters' insurance.

- They have expensive personal items like laptops, phones, or instruments - BUT BE SURE TO LET YOUR AGENT KNOW THAT THESE EXIST.

- The student is changing their legal residence to their college address (for example, updating their driver’s license).

- Their name is on the lease rather than the parents name

Steps Parents Should Take

- Check your homeowners policy – ask your insurance agent about off-premises coverage limits.

- Take an inventory – list and photograph the valuables your student brings to school.

- Compare renters insurance quotes – policies are usually affordable and can be customized for Florida’s risks. For many families, this is the easiest way to find cheap renters' insurance in Florida for college students.

- Ask about replacement cost coverage – this pays to replace items at today’s prices, not the depreciated value.

- Discuss high-value items – confirm whether jewelry, high-end electronics, or musical instruments need special riders or add on coverage.

The Bottom Line

A parents Homeowners insurance often isn’t enough for college students living away from home. In Florida, where storms and theft risks are higher, renters insurance is a smart, affordable solution—just $15–$30 a month, less than $1 a day. It’s the easiest way to protect your student’s belongings, liability, and peace of mind.

Protect Your Student Today

Get a customized renters insurance quote in minutes. We work with top companies to find the best coverage at the best price.

Get a Renters QuoteCompanies We Work With

We proudly write renters insurance policies with trusted carriers, including:

- Auto-Owners

- Progressive

- Nationwide

- Tower Hill

- Universal

- And many others

We compare rates across top carriers so you don’t have to.

Frequently Asked Questions (FAQ)

Is renters' insurance required for Florida students?

Not always. Many Florida landlords and some universities require proof of renters insurance before move-in. Even when it’s optional, it’s smart protection against theft, storms, and liability—especially for laptops and electronics. Policies are affordable and quick to set up.

How much does renters insurance cost for college students in Florida?

Most student policies cost about $15–$30 per month—often less than $1 a day. Pricing varies by coverage limits, deductible, and options like replacement cost. It’s a low monthly expense compared to replacing a laptop, phone, or bike after a loss.

Does homeowners insurance cover college students in Florida?

Sometimes. Many homeowners policies extend roughly 10% of personal property coverage to belongings away from home, and they usually exclude damage to the rental itself. Renters insurance often fills these gaps with clearer limits for belongings, liability, and additional living expenses.

What does renters insurance cover for students in Florida?

Typically personal belongings (clothes, electronics, furniture), liability if someone is injured or property is damaged, and additional living expenses if the dorm or apartment becomes uninhabitable. Ask your agent about high-value items—jewelry, laptops, or instruments—which may need scheduling or higher limits.

Is renters insurance worth it for college students?

Yes. For under a dollar a day, students get coverage for belongings, liability, and temporary housing. In Florida—where hurricanes, storms, and theft can cause losses—renters insurance delivers affordable peace of mind for families sending students to campus or off-campus housing.

mind — especially in Florida, where hurricanes, storms, and theft can create unexpected losses.