These Electric Panels Are Uninsurable in Florida—Is Yours on the List?

Older homes in Florida often come with surprises—some charming, some costly. One of the biggest hidden risks we see is the electrical panel, which can cause major insurance issues in Florida. If your home has an outdated or recalled panel, you may struggle to pass a 4-point inspection or even face having your Florida home insurance cancelled because of the panel.

In this article, I’ll walk you through what your electrical panel does, which panels are red flags for insurance companies, and what to do if your home has one.

What Is an Electrical Panel?

Your electrical panel is the central hub for power distribution in your home. It routes electricity from your utility provider to lights, appliances, and other systems. Each circuit is protected by a breaker designed to trip in case of an overload or short circuit.

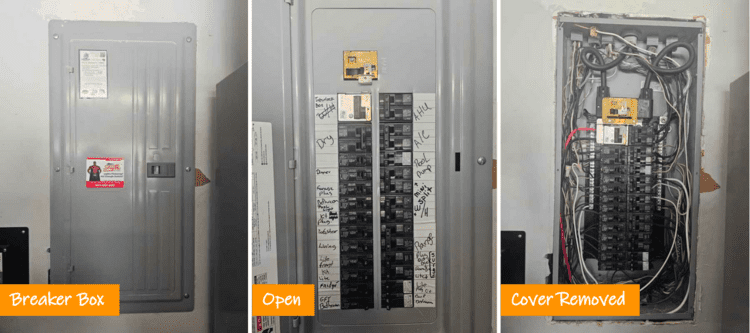

What Does an Electrical Panel Look Like?

Most electrical panels are located in laundry rooms, garages, or utility closets. They vary in size and layout, but generally contain a metal box with circuit breakers lined up inside.

Here’s a typical example of a modern residential breaker panel (pictured below). This one does not show a recalled or high-risk model — but it gives you an idea of what the inside of your panel might look like with the cover removed.

Ineligible Electrical Panels That Can Get Your Home Insurance Denied or Cancelled in Florida

On top of the safety risks, certain electric panels can cause major insurance headaches. We’ve seen clients get turned down for new policies when buying a home or switching insurance companies—and others dropped at renewal—just because of the type of panel in the home. These brands have had safety recalls and are a known fire risk

Why is My Electric Panel Uninsurable?

An electrical panel is considered uninsurable when it poses safety risks that make home insurance companies unwilling to provide coverage.

Common reasons include:

- Known fire hazards

- Failure to trip during electrical surges or overloads

- Manufacturer recalls or defects

- Lack of replacement parts for obsolete models

- High failure rates on 4-point inspections in Florida

These panels often include brands like Federal Pacific (FPE), Zinsco, and Challenger, all of which are commonly flagged by insurers due to documented safety issues.

Which Electric Panels Fail a 4-Point Inspections in Florida?

Before issuing a new policy on an older Florida home, most insurers require a 4-point home inspection. If you're unsure what kind of panel you have, a licensed Florida electrician or inspector can help identify it — especially if you’re preparing for a 4-point inspection.

If your panel is one of the following brands, expect to be flagged or denied new insurance coverage until they are replaced:

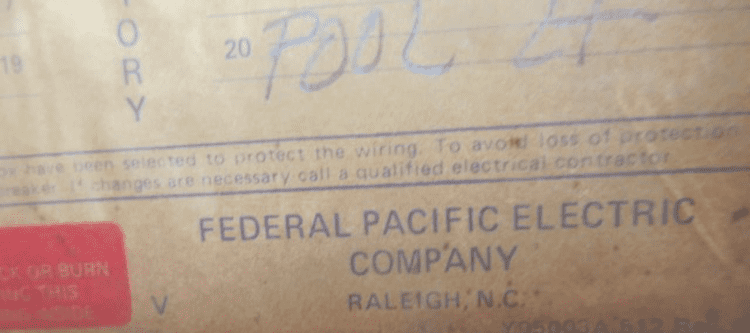

1. Federal Pacific Electric (FPE) or Stab-Lock Breakers

- Years used: 1950s–1980s

- Problem: These panels used Stab-Lok breakers, which are known to fail to shut off during an overload or short circuit. In testing, many of these breakers failed to trip as often as 1 in 4 times, creating a serious fire risk.

- What it looks like: Panel door marked "FPE" or "Federal Pacific," breakers labeled "Stab-Lok."

- Insurance stance: Most insurers will decline coverage until the panel is replaced—whether it's labeled FPE or just Stab-Lok. Both are considered high risk.

2. Zinsco / Sylvania Panels

- Years used: 1950s–1970s

- Problem: Breakers can overheat, fuse to the bus bar, and stay live even when turned off.

- What it looks like: Vertical rows of colorful breakers, marked Zinsco or Sylvania.

- Insurance stance: Usually rejected by insurers. Replacement required.

3. Challenger Panels

- Years used: 1980s–1990s

- Problem: Known to overheat, especially as they age. Some components were recalled.

- What it looks like: Panel or breakers labeled "Challenger."

- Insurance stance: Increasingly flagged. Some insurers allow temporary coverage with a required upgrade. in 2024, Citizens Insurance will still accept these panels however, citizens is the insurance company of last resort. They are still a known fire hazard, and should be replaced.

4. Pushmatic Panels (Honorable Mention)

- Problem: Old, hard to service, and no longer manufactured. Some have been known to fail under load.

- Insurance stance: Often flagged, though not as strictly as the panels above.

How to Pass a 4-Point Inspection in Florida If Your Electrical Panel is Uninsurable

✅ Start with a Licensed Electrician

Have a professional take a look and give you a quote. You’ll want a clear assessment of whether your panel really needs to be replaced—and how much it’ll cost.

✅ Be Ready to Replace It

In most cases, replacement is the only safe option. For a typical 200-amp service, you’re looking at around $2,500 to $5,000. Some utility companies or local programs may help with the cost, so it’s worth checking.

✅ Save Your Paperwork

Hold on to everything—photos, electrician reports, invoices. Some insurance companies will ask for proof of the upgrade, and having documentation makes things go more smoothly. You may also need to get the 4 point inspection redone once you have had the new panel installed.

✅ Talk to Your Insurance Agent Early

Don’t wait until you’re under pressure. We help Florida homeowners with this every day and can guide you through your options.

✅ Buying a Home? Negotiate Early

If you’re in the process of buying a home and the panel is on this list, try to negotiate with the seller to have it replaced before closing. That way, you’re not stuck dealing with insurance or safety issues right after you move in. You can also read our guide on what to expect from a 4-point inspection in Florida.

Want us to help with your insurance?

👉 Get a Florida homeowners insurance quote or give us a call at 904-268-3106. We’ll make the process simple—and safe.

Summary: What You Need to Know

- Federal Pacific, Zinsco, Challenger, and Pushmatic panels are red flags for insurers.

- These panels often cause failed 4-point inspections in Florida.

- Replacing your panel can unlock better insurance options and rates.

- We can help you review coverage and meet inspection requirements — get a quote today.

Protect Your Home with the Right Coverage

Get a fast and personalized homeowner's insurance quote from a local Florida expert you can trust.

Get My Quote NowFrequently Asked Questions

Can I still get home insurance in Florida if I have a Federal Pacific or Zinsco panel?

Most insurance companies will refuse to insure a home that has this type of panel or cancel an existing policy if these panels are present due to known fire risks. It’s best to replace the panel before shopping for new insurance.

What are the most common electrical panel insurance issues in Florida?

Florida home insurance providers often deny or cancel policies for homes with panels like Federal Pacific (FPE), Zinsco, or Challenger due to fire risk and failure rates.

Will replacing my electrical panel help with my insurance?

Yes. Replacing an outdated or unsafe panel often allows you to qualify for more insurance options and potentially lower premiums.

How much does it cost to replace a problematic panel?

Costs vary, but most homeowners spend between $1,500 and $3,500, depending on your home’s electrical setup and your location.

After a failed 4-point inspection, how soon do I need to replace my panel?

Most companies will refuse to issue a new policy to a home with one of these panels. If your insurance company inspects your home, they also may issue a replacement deadline, typically within 30–60 days. Acting quickly ensures your policy stays active.

👉 Get a Florida homeowners insurance quote or give us a call at 904-268-3106. We’ll make the process simple—and safe.

Related Reading

- What is a 4-Point Inspection in Florida and Why It Matters

- 25 Largest Homeowners Insurers in Florida: 2024 Updated List

- Is Aluminum, Cloth, and Knob & Tube Wiring a Florida Home Insurance Dealbreaker?

Need help getting homeowners insurance?

If you're not sure where to start, we’re here to help. At Augustyniak Insurance, we work with Florida homeowners every day who are dealing with electrical panel issues. Whether you're buying a home or reviewing your current coverage, we’ll walk you through your available options or help you find a company that fits your needs.

Protect Your Home with the Right Coverage

Get a fast and personalized homeowner's insurance quote from a local Florida expert you can trust.

Get My Quote Now

Discussion

There are no comments yet.