What is a Workers' Comp Insurance audit?

Introduction

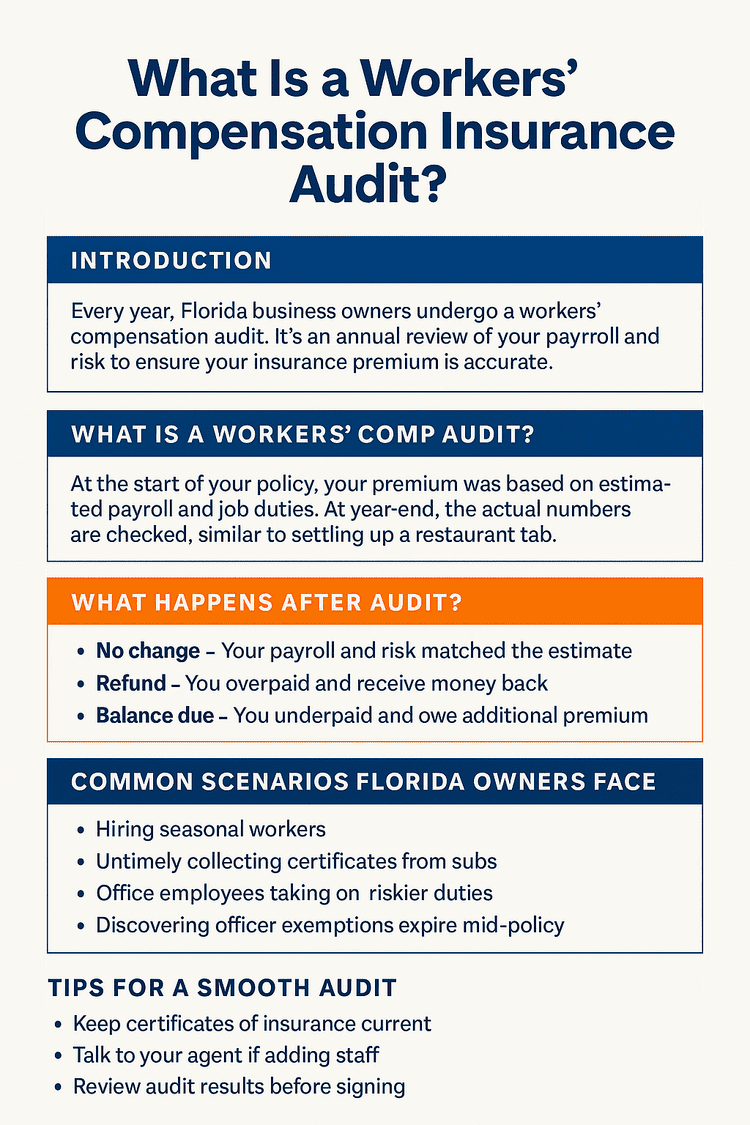

Every year, Florida business owners get a notice from their insurance carrier: it’s time for a workers’ comp audit. For many, this is a confusing and stressful process.

The truth is, a workers’ comp audit isn’t about “catching you doing something wrong.” It’s about making sure your premiums are fair based on your actual payroll and risk.

This article is your guide to workers’ comp audits in Florida—what they are, why they matter, and what to expect as a business owner.

👉 For the basics of coverage itself, see our Florida workers’ comp insurance overview.

What Is a Workers’ Comp Audit?

When you first purchased your policy, your workers' compensation premium was based on an estimate: the amount of payroll you expected to pay your employees during the policy year and the type of work they would perform.

At the end of the policy year, the carrier checks the actual numbers and compares them against the estimate. That’s the audit.

Think of it like settling up a restaurant tab. You gave a deposit, but now the bill is due—sometimes you owe more, sometimes you get change back.

Why Florida Requires Audits

Audits are required by Florida law and the NCCI to keep the system fair:

- A roofing company shouldn’t pay the same rate as an office supply store.

- Businesses that grow during the year should pay their share.

- Subcontractors must be properly insured, or their costs fall back on the business that hired them.

Without audits, businesses could underreport payroll and risk, driving up costs for everyone else.

What Happens After the Audit?

There are three typical outcomes:

- No change – Your estimates matched reality.

- Refund – Your payroll was lower than expected, so you get money back.

- Balance due – Your payroll or job duties were higher-risk, so you owe more.

👉 Example: A small landscaping company estimated $200,000 payroll. By year-end, payroll hit $250,000 due to new hires. The extra $50,000 is added at audit, and the premium increases retroactively.

Get a Florida Workers’ Comp Quote today.

Common Scenarios Florida Business Owners Face During Work Comp Audit

Florida business owners often run into similar pitfalls during their annual workers’ comp audit. Here are the most common ones that can affect your premium:

Seasonal Hiring Surprises

Restaurants, hotels, and other hospitality businesses often underestimate payroll during peak seasons. When extra staff are hired, payroll numbers climb and the audit adjusts the premium upward.Subcontractor Headaches

If you don’t collect valid Certificates of Insurance for subcontractors, their payroll may be charged back to your policy. An exemption only applies to the one person named—not the whole company.Expired Officer Exemptions

Business owners sometimes assume they are still exempt from coverage, but exemptions expire every two years. If one lapses, the auditor will count that officer’s wages as covered payroll.Job Duty Changes

Employees classified as “clerical” might start doing site visits or light fieldwork. Since that work is riskier, the auditor may reclassify them, which raises your premium.

👉 Tip: Verify subcontractor coverage ahead of time and use the Florida exemption database

What an Audit Is Not

Many owners fear the work compensation insurance audit like an IRS tax audit. But it’s not that. A workers’ comp audit is:

- Routine and happens yearly

- Required by your insurance carrier and every insurance company

- Focused on payroll and risk—not your overall finances

Tips for a Smooth Audit (Big Picture)

While we’ll cover checklists and documents in later articles, here are a few “big picture” tips that apply to every Florida business:

- Stay organized year-round: Don’t wait until audit notice arrives to track subcontractor certificates or job duties.

- Think ahead: If your business is growing fast, talk to your agent mid-year about adjusting your estimates.

- Ask questions: Don’t sign audit paperwork you don’t understand. Auditors can make mistakes, too.

Final Thoughts

The Florida workers’ comp audit doesn’t have to be a headache. Think of it as a balancing act—making sure your coverage matches your reality. If you stay proactive with payroll, subcontractor certificates, and exemptions, you’ll avoid nasty surprises and maybe even get a refund.

👉 Want to make sure your policy is set up right before audit season? Get a Florida workers’ comp quote today.

Why work with us

Augustyniak Insurance has 2,000+ Google reviews and would be happy to help with work comp needs and coverage questions.

Get a Florida Workers’ Comp QuoteFAQs

Is a workers’ comp audit mandatory in Florida?

Yes. Carriers audit to verify actual payroll, job duties, and subcontractor coverage so premiums remain fair.

Do I need to involve my accountant?

It’s often helpful. Your bookkeeper or CPA can supply payroll summaries, W-2s/1099s, and subcontractor documentation.

Where can I verify Florida Work Comp exemptions?

Use the State of Florida’s database: https://apps.fldfs.com/bocexempt/.

Discussion

There are no comments yet.