Whether you’re driving in Jacksonville, Orlando, Miami, or anywhere across Florida, you know driving in Florida can be stressful. Auto insurance can feel the same way — full of twists and turns.

Florida requires every driver to carry Personal Injury Protection (PIP) on their Auto Insurance policy, but PIP has strict limits. Many drivers are unaware that these limits could result in thousands of dollars in unpaid medical bills following an accident. That’s where Medical Payments coverage (MedPay) on your auto insurance policy comes in.

PIP covers medical bills and lost wages after an accident in Florida, regardless of fault, with a $10,000 per-person limit. MedPay is optional coverage that pays the remaining balance and works out of state.

Let’s break down both coverages, how they overlap, and why smart Florida drivers often carry both.

🛡️What is Personal Injury Protection (PIP)?

Standard or Basic Personal Injury Protection (PIP) in Florida is a required coverage on everyone's Florida Auto Insurance Policy. PIP is a no-fault auto insurance coverage that pays 80% of medical expenses and 60% of lost wages after an accident, up to a maximum of $10,000 per person.

PIP is the foundation of Florida’s no-fault system, intending to ensure prompt payment of benefits after an accident — regardless of who was at fault. Every driver in the state is required to carry it, making it the cornerstone of auto insurance coverage for Jacksonville and all Florida drivers.

Basic PIP Covers:

- 80% of medical bills (ER, ambulance, doctor visits, hospital stays, etc.)

- 60% of lost wages if you can’t work after an accident

- $5,000 death benefit

- Maximum Payable of $10,000 per person

👉 Per-person limit: PIP pays these benefits for each person covered under your policy, up to $10,000 per injured individual. If three people in your car are injured, each has access to $10,000 of PIP benefits.

Upgrades to PIP:

You can purchase two types of upgrades to PIP in Florida on your insurance policy-- if you ask your agent about them. But typically, MedPay is less expensive for similar (not identical) coverage.

- Extended PIP: Raises PIP coverage from 80% to 100% of medical bills and from 60% to 80% of wages. It's still capped at $10,000 maximum..

- Additional PIP: Increases the limit (for example, $20,000 or more, per person). But the percentages paid still are 80% medical and 60% work loss.

🌴The “Out of State, Out of Your Car = Out of PIP” Rule in Florida

Florida’s Personal Injury Protection (PIP) follows you in your own car, but won’t apply in rentals out of state or while in friends’ cars out of state. It's not a universal safety net, and there is a critical rule that can leave you financially exposed if you don't have supplemental coverage.

The Rule: Your Florida PIP policy will cover you and resident relatives anywhere in the United States or Canada, as long as you are in a vehicle you own that is covered by your Florida policy. (Reminder: This rule applies only to PIP and not other types of coverage on an auto policy)

- In Florida – Your Car: ✅ PIP applies.

- In Florida – Passenger in another car: ✅ PIP still follows you.

- Out of State – Driving your own Florida car: ✅ PIP applies.

- Out of State – Rental or friend’s car: ❌ No PIP coverage.

Examples:

Driving your Florida car in South Carolina → ✅ PIP Covers

Riding in a friend’s car in Georgia → ❌ PIP Not covered.

Rental car in Alabama → ❌ No PIP. Not covered.

👉 This is where MedPay becomes important. Adding MedPay to your Florida auto insurance can close these gaps — get a personalized auto quote.

⚕️What is MedPay in Florida? How Medical Payments Coverage Fills Gaps

Medical Payments coverage (MedPay) is optional auto insurance in Florida that pays the portion of medical bills PIP doesn’t cover after an auto accident. Med Pay also follows you out of state, with limits you selected. MedPay is typically affordable coverage. It's especially a great option for people with no health insurance or those with high deductibles or limited coverage.

From Jacksonville commutes on I-95 to Orlando theme park trips or Miami traffic, MedPay closes dangerous coverage gaps. It pays quickly and directly, without deductibles or network restrictions, making it one of the simplest ways to protect yourself and your passengers. While optional, MedPay works hand-in-hand with PIP to ensure you aren’t left with thousands in unpaid medical bills.

What MedPay Does Cover:

- Pays the 20% balance PIP leaves behind

- Covers bills above your PIP limit (up to your MedPay limit)

- Works out of state (including rentals and other cars)

- Pays regardless of fault — even if you caused the accident

- Provides a per-person limit (if you and two passengers are injured, each person has their own MedPay limit)

- Pays immediately, no deductibles or network restrictions

⚠️ What MedPay Does Not Cover:

- Lost wages

- Replacement services (like childcare or cleaning help)

- Death benefits

Florida PIP vs MedPay: Side-by-Side Comparison

| Feature | Basic PIP | Extended PIP | Additional PIP | MedPay (Medical Payments) |

|---|---|---|---|---|

| Required? | Yes, $10,000 minimum | Optional | Optional | Optional |

| Pays Regardless of Fault? | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

| Pays First or Second? | First | First | First (higher limit) | Second |

| Medical Bills | 80% up to $10K | 100% up to $10K | 80% up to higher limit | 100% of leftover up to Medpay Limit |

| Lost Wages | 60% | 80% | 60% up to higher limit | ❌ |

| Death Benefit | $5,000 | $5,000 | $5,000+ | ❌ |

| Per-Person Limit | ✅ $10,000 per person | ✅ $10,000 per person | ✅ Higher per person | ✅ Limit per person |

| Out-of-State Coverage | Limited (your car only) | Limited | Limited | ✅ Yes |

📝Real-World Claims Examples: How it Plays Out

Here are real Florida PIP vs MedPay claim examples showing how different coverages work in practice.

Scenario 1: $10,000 in Medical Bills (PIP vs Med Pay)

Imagine a smaller accident where your medical bills total $10,000 for one person.

Even at this level, the difference between relying on PIP alone and adding MedPay can be dramatic. Here’s how your out-of-pocket costs change depending on the type of coverage you purchased:

- Basic PIP only: PIP pays $8,000 (80% of $10,000) → You owe $2,000.

- Basic PIP + $5,000 MedPay: PIP pays $8,000 (80% of $10,000) → MedPay pays $2,000 → You owe $0.

- Extended PIP only: PIP pays $10,000 (100% of $10,000) → You owe $0.

- Additional PIP ($20K) + No MedPay: PIP pays $8,000 (80% of $10,000) → You owe $2,000.

- Additional PIP ($20K) + $5,000 MedPay: PIP pays $8,000 → MedPay pays $2,000 → You owe $0.

Scenario 2: $15,000 in Medical Bills

Let's imagine a driver on I-95 in Jacksonville gets into an accident with $15,000 in medical bills. Here’s how their coverage would work. Your out-of-pocket costs depend on whether you only carry the state-required PIP or if you’ve added MedPay or upgraded your PIP:

- Basic PIP only: PIP pays $10,000 → You owe $5,000.

- Basic PIP + $5,000 MedPay: PIP pays $10,000 (max limit) → MedPay pays $5,000 → You owe $0.

- Extended PIP + $5,000 MedPay: PIP pays $10,000 → MedPay pays $5,000 → You owe $0.

- Additional PIP ($20K) + No MedPay: PIP pays $12,000 (80% of $15,000) → You owe $3,000.

- Additional PIP ($20K) + $5,000 MedPay: PIP pays $12,000 (80% of $15,000) → MedPay pays $3,000 → You owe $0.

Scenario 3: $50,000 in Medical Bills

Now let's examine a much larger accident that results in $50,000 in medical bills. Here’s how your coverage would work. Your out-of-pocket costs depend on whether you only carry the state-required PIP or if you’ve added MedPay or upgraded your PIP: Here are a few examples of how this plays out with different coverages purchased.

- Basic PIP only: PIP pays $10,000 (max limit $10K)→ You owe $40,000.

- Basic PIP + $20,000 MedPay: PIP pays $10,000 → MedPay pays $20,000 → You owe $20,000.

- Extended PIP + $20,000 MedPay: PIP pays $10,000 → MedPay pays $20,000 → You owe $20.000

- Additional PIP ($20K) + No MedPay: PIP pays $30,000 (Basic $10K + Additional $20K) → You owe $20,000.

- Additional PIP ($20K) + $20,000 MedPay: PIP pays $30,000 → MedPay pays $20,000 → You owe $0.

Scenario 4: Suing the At-Fault Driver

In Florida, you can step outside of the no-fault system and file a lawsuit against the at-fault driver if your injuries meet the “serious injury threshold”, which includes permanent injury, significant and permanent scarring or disfigurement, or significant loss of a bodily function. Given $50,000 in medical bills, it’s likely this threshold could be met.

If the at-fault driver has Bodily Injury Liability (BI) insurance, their policy would be a source of funds to pay for your remaining medical bills, lost wages, and pain and suffering. However, unlike many other states, BI coverage is not mandatory for Florida drivers, and many drivers carry low limits in Florida

- If the at-fault driver has BI insurance, you or your attorney would file a claim with their insurance company for the damages not covered by your PIP and MedPay.

- If the at-fault driver has no BI insurance or low limits, You would need to rely on your own Uninsured/Underinsured Motorist (UM) coverage, if you purchased it.

Important: This option is only available for accidents where you are not at fault. If you cause an accident, you cannot sue yourself or your own insurance company for non-economic damages.

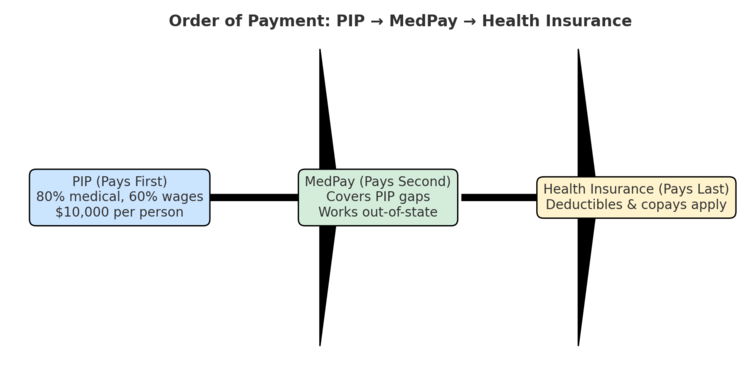

PIP vs MedPay vs Health Insurance in Florida

Florida law makes PIP primary, so your auto policy pays before health insurance.

- PIP pays first (by law, regardless of fault).

- MedPay pays second, covering the gaps.

- Health insurance pays last, often with deductibles and copays.

👉 For families with high-deductible health plans, MedPay can prevent thousands in out-of-pocket costs.

PIP vs MedPay vs Health Insurance Comparison

| Feature | PIP | MedPay | Health Insurance |

|---|---|---|---|

| Required in Florida? | ✅ Yes | ❌ No | ❌ No |

| Pays Regardless of Fault? | ✅ Yes | ✅ Yes | Silent |

| Order of Payment | Always first | Always second | Pays last |

| Deductibles/Networks? | ❌ None, unless selected | ❌ None | ✅ Yes |

| Covers Lost Wages? | ✅ Yes | ❌ No | ❌ No |

| Per-Person Limit | ✅ $10K+ | ✅ Limit you choose | Depends on the plan |

| Covers Out of State? | Limited | ✅ Yes | ✅ Yes |

Why Florida Drivers Should Care

From daily commutes across Florida to road trips to Georgia or Alabama, coverage gaps are a real risk.

- Example: Imagine you’re heading to a Jaguars game with three friends. If everyone gets injured, each person receives their own $10,000 PIP limit plus their MedPay limit. That per-person feature prevents one accident from draining all your benefits.

- PIP alone may not cover you if you’re in a rental car out of state.

- Even in Florida, it only pays 80% of medical bills.

👉 Bottom Line: Adding MedPay to your Florida auto insurance can close these gaps — get a personalized auto quote.

⚠️ Important Note

This information is provided for general educational purposes only and should not be considered legal or insurance advice. Every situation is different, and coverage can vary based on your policy and carrier.

If you have specific questions about how Personal Injury Protection (PIP) or any other coverage applies to your needs, be sure to review your policy carefully and speak directly with your insurance agent.

If you don’t currently have an agent—or would like a second opinion—our team at Augustyniak Insurance Group would be happy to help. We take the time to answer your questions and make sure you have the right protection in place.

💥Frequently Asked Questions (FAQ)

Q: Do PIP and MedPay pay if I caused the accident?

A: Yes. Both pay regardless of who was at fault.

Q: Are the limits per accident or per person?

A: They are per person. For example, if three passengers in your car are injured, each gets their own $10,000 PIP limit, plus MedPay if you purchased it.

Q: Do I need MedPay if I already have health insurance?

A: Yes. MedPay pays immediately with no deductibles or network restrictions, and it covers situations where health insurance may delay or deny claims.

Q: Can I choose MedPay instead of PIP?

A: No. PIP is required by Florida law. MedPay is optional but highly recommended.

Q: How much MedPay should I buy?

A: Common limits are $2,000, $5,000, $10,000, or $25,000. Many Florida families choose $5,000 or $10,000 for a strong safety net.

Q: Does PIP cover pedestrians or cyclists in Florida?

A: Yes. If you’re hit while walking or biking in Jacksonville, your own PIP pays first.

Q: Does MedPay cover my health insurance deductible?

A: Yes. MedPay can reimburse you for deductibles and coinsurance that health insurance leaves behind.

Q: If someone else is at fault, do I still have to file a claim on my own insurance for PIP?

A: Yes. The first $10,000 of medical bills comes from your own auto policy (your PIP), regardless of who is at fault

Related Articles

Get a Florida Auto Insurance Quote