FEMA (Federal Emergency Management) publishes a standardized form called an elevation certificate. A Surveyor usually completes the form, but can also be done by a engineer or architect.

The information on this form is used determine the cost of flood insurance for a specific property located in a high risk flood zone (A, AE, V, VE, etc).

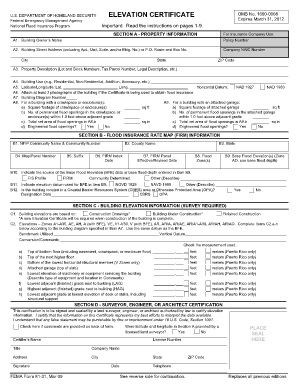

The Elevation Certificate Provides:

- Address, Description, and Usage of Property

- Flood Insurance Rate Map (FIRM) Information

- Flood Zone of the Property

- Base flood elevation for the property

- Number of Feet above the base flood elevation your particular house or commercial property was built.

- Color photos of all sides of the building

Each building on your property will need a separate elevation certificate. You only need it when you property is in a high risk flood zone zones. If your home is in a low or moderate risk zone (X, C, B) you will not need this document.

Is an elevation certificate required?

No. There are three options without an elevation certificate.

1) You can get flood insurance through the National Flood Insurance Program (NFIP) without an elevation certificate. However, flood insurance premiums are thousands or tens of thousands of dollars more without one. We recommend having an elevation certificate on your property when it's in a high risk flood zone like A, AE, V, or VE.

2) You can purchase a flood insurance policy from a private insurer. We offer several options for this, but the availability and price depends on your location in Florida. Their price compared to the NFIP program varies greatly. Sometime it is less expensive. Sometimes it is more expensive.

3) Find a homeowners company that will provide Flood Insurance by endorsement on a homeowners policy. We offer Progressive Home Insurance, American Integrity Homeowners Insurance, and a few others that bundle home and flood on the same policy. This is not common in Florida and is subject to underwriting requirements on the homeowners insurance policy.

Using an Old Elevation Certificate

You can use an old certificate to purchase flood insurance. You can even use one provided by a former owner, as long as there have not been substantial changes to the homes foundation or footprint. If you want to use an older certificate, you will likely be asked by your agent to provide new color photos of the front and rear of the structure. If the property is a condo, check with your condo association to see if they have an elevation certificate or carry flood insurance on your behalf.

How much does a Flood Elevation certificate cost?

If you can't locate your certificate or if FEMA recently changed your flood zone to high-risk, you will want to obtain a new certificate. An elevation certificate results in the most affordable flood insurance in an A, AE, V, or VE zone. If you do not have a Flood elevation certificate, a land surveyor can visit your property and prepare this document for you. The typical cost of an elevation certificate is between $350 and $550. If you are in need of an elevation certificate, you would call a land surveyor.